- TURBO TAX CALCULATOR HOW TO

- TURBO TAX CALCULATOR SOFTWARE

- TURBO TAX CALCULATOR PLUS

- TURBO TAX CALCULATOR SERIES

Before submitting, they must double-check the contents. Users of Turbo Tax Calculator need to verify the information they give. The only way to guarantee the accuracy of the tax preparer is to practice due diligence. Depending on the package, users may not have access to all types of tax forms.

TURBO TAX CALCULATOR SOFTWARE

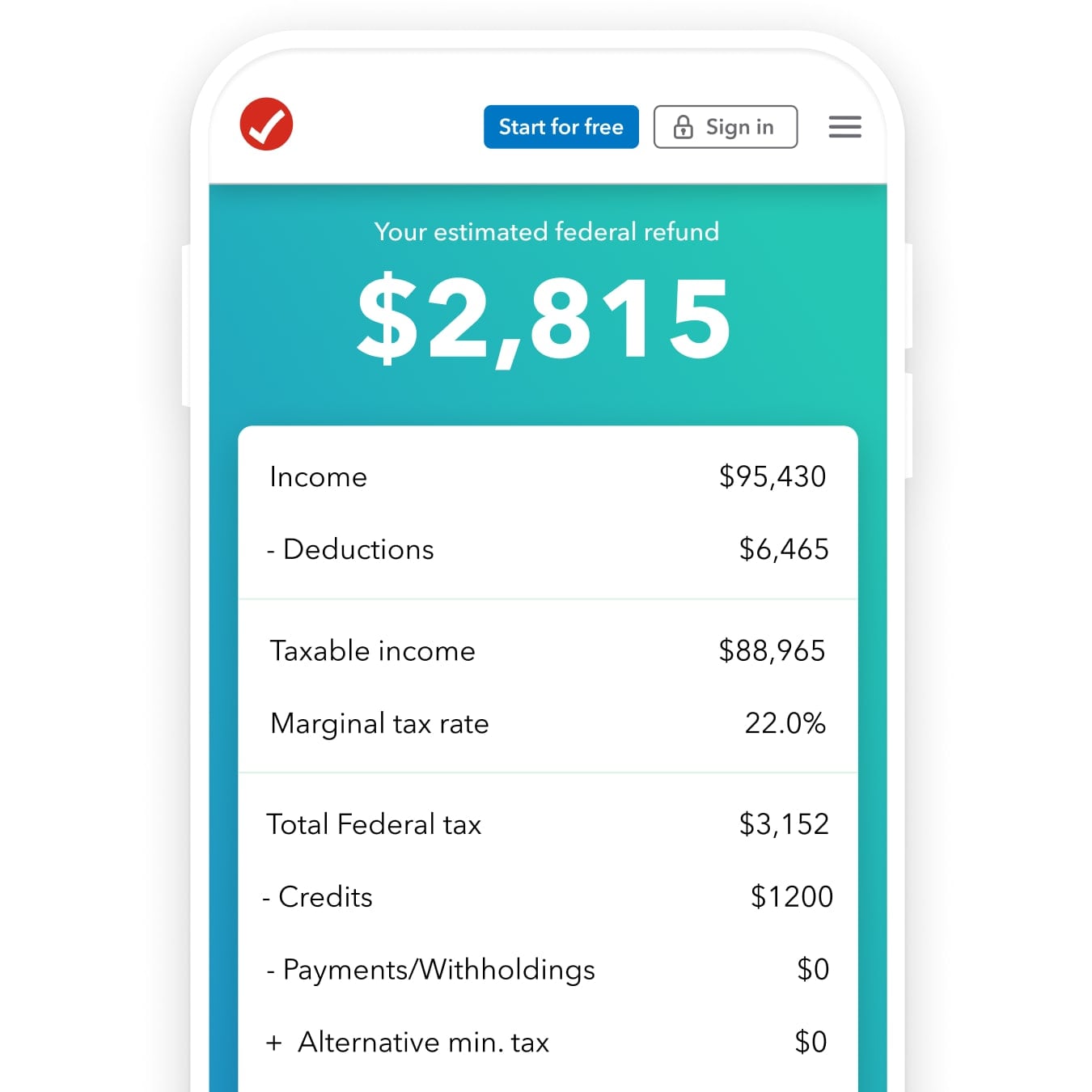

There are also many ways to encounter errors, including giving the wrong information to the software and the tax specialist. In the process, it reduces redundancy and introduction of errors. The software can transfer federal income tax information to state if the individual needs to do both.It is easy to use, so the chances of making mistakes decrease.It can offer data such as when a person may expect a tax refund.It ensures it provides up-to-date information to the IRS and users. The software updates its version on a regular basis.It combines the preciseness of its technology and the knowledge and personalized tax advice.Is Turbo Tax returns calculator accurate? On a personal note, it is: The comprehensiveness of the features and services, though, is only second priority. It is a favorite even if it tends to be pricier than its competitors. There’s no doubt this tax software is one of the most popular in the market.

TURBO TAX CALCULATOR PLUS

It has all the advantages of other editions, plus extra features. This is the most comprehensive of all the tax calculators of Turbo Tax.

TURBO TAX CALCULATOR HOW TO

RELATED: How To Use Nanny Tax Calculator 4. It has the benefits of Free and Deluxe editions. It can also import the necessary financial information to calculate capital gains and loss and cost basis. These include earnings from stocks, bonds, real estate including rental, and cryptocurrency. This is the Turbo Tax Calculator for people with investment income. They also pay for the tax service only when they file the returns. Users can also receive the guidance or support from a tax expert. It can also help convert donations into additional significant deductions. In turn, it helps taxpayers maximize their deduction and refund. It works like the Free version, but the biggest difference is it searches among its 300+ types of deductions and credits.

This is the most popular Turbo Tax Calculator. It is not for individuals who need to provide itemized deductions, business income, or rental income, among others. There’s also no cost in actually submitting the tax form. It is free whether the taxpayer is filing a state or federal income tax.

TURBO TAX CALCULATOR SERIES

People with W-2 income can also take a snapshot of the form and answer a series of questions in relation to tax data. It is also for those filing 1099-NT or 10999-DIV (limited interest and dividend income). It is applicable for people with child tax credits, earned income tax credit (EIC), and standard deduction claims. It means they submit Form 1040 with no other schedules attached to it. This program is available for taxpayers with a simple tax return. Taxpayers can choose among the different Turbo Tax Calculators: 1. So, if any company or organization calls claiming you have unpaid taxes, DO NOT respond to these unsolicited calls. Do not respond to these calls as the IRS will typically send letters or notices via U.S. UPDATE: Recently we have learned of instances where consumers are also getting automated calls regarding “unpaid taxes”. There are special circumstances when they may reach out via phone regarding overdue tax bills or delinquencies, but almost always only after they’ve already sent a letter first. The IRS initiates most contacts with taxpayers through regular mail delivered by the U.S. does not make these automated calls to consumers and it is our policy not to engage in this form of marketing.If you have received such a call, please let us know by emailing so that we may report this unauthorized activity.Īdditionally, the IRS does not use email, text messages or social media to discuss tax debts or refunds with taxpayers.

We have recently become aware of companies and/or organizations who are calling people using the generic name "Tax Relief Center" for their phone solicitation activities.

0 kommentar(er)

0 kommentar(er)